Personal Finance

Matthew Rensberry, MD, MBA

Introduction

This is an opinionated talk (Mine - though heavily influenced by reputable sources).

NOTE: Financial Advisers do not need to be licensed!

Some Influential Books

- The White Coat Investor: A Doctor's Guide To Personal Finance And Investing by James M Dahle MD

- The Coffeehouse Investor: How to Build Wealth, Ignore Wall Street, and Get On with Your Life by Bill Schultheis

- The Millionaire Next Door: The Surprising Secrets of America's Wealthy by Thomas J. Stanley and William D. Danko

- The Automatic Millionaire: A Powerful One-Step Plan to Live and Finish Rich by David Bach

Steps to Financial Independence

- $1000 in Emergency Savings

- Pay off all debt

- Fully fund Emergency Savings

- Invest 15-20% of income

- Save for college

- Pay off your house early

- Build wealth and give!

– Dave Ramsey –

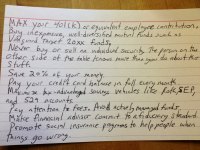

Harold Pollack's Index Card

- Max your 401k or equivalent employee contribution

- Buy inexpensive, well diversified mutual funds

- Never buy or sell an individual security

- Save 20% of your money.

- Pay your credit card balance in full every month

- Maximize tax-advantages savings vehicles like Roth, SEP and 529 accounts

- Pay attention to fees - Avoid actively managed funds

- Make financial advisor commit to a fiduciary standard

- Promote social insurance programs to help people when things go wrong

Building Wealth

Live your life with purpose and create a better world for others.

Avoid the trap of maximizing your wealth, but not your life.

Wealth

Wealth = Assets - Liabilities

- Assets are something that gives you money and financial security, on the long term.

- Liabilities are something that requires you to give money and time, or causes you to owe money to others.

Build your wealth mindset!

Rich vs Wealthy

| Rich Person | Wealthy Person |

|---|---|

| High income | Having enough money to meet your needs, AND being able to afford not to work if you don’t have to |

| Spends on Liabilities (Buys expensive furniture, fancy cars, big houses, and designer clothing) | Saves and Invests extra money (Owns assets such as real estate, investments, and cash) |

| Thinks: Spending money buys a better life quality | Recognizes: Wealth gives real financial freedom to enjoy luxuries in life without suffering a decrease in money |

| Might carry a lot of debt | Uses debt only for a very clear purpose, such as an investment on a house |

A Couple Examples

MC Hammer at one point had $30 million in the bank, a $1 million house with 200 staff members, and a horse stable with 19 racehorses. Eventually, those expenses and his spending, resulted in Hammer declaring bankruptcy in 1996. He ended up in $13 million in debt.

Despite his massive wealth, Warren Buffet still lives in the Nebraska home he bought in 1958 for $31,500. While he did purchase a vacation beach house in California for $150,000 in 1971, he ended up selling it for $7.5 million.

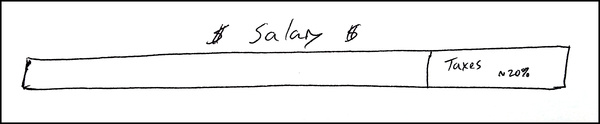

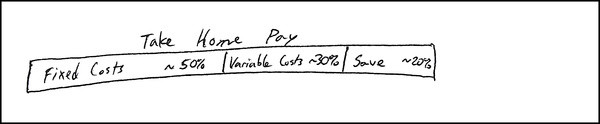

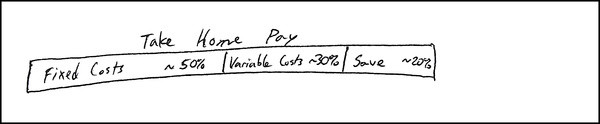

Personal Budgeting (50/20/30 Rule)

- Key to growing wealth: Live below your means

- Recognize Wants vs Needs - Essential (Food) vs Non-essential (Restaurants)

- Saving = Paying off debts = Investing

Simpler => Better

Instead of a 50/20/30 rule think….

80/20

Automate, Automate, Automate!

The only way to improve your financial security is to arrange to automatically save 10-15% of your income before you even have a chance to spend it.

Automate as much of this process as you can!

Step 1: Start an Emergency Fund

- Start today! ($1000)

- Use a highly liquid account with an acceptable return

- Savings account

- Money market account

- Certificate of deposits (CDs)

Step 2: Pay off Debt

Pay off:

- Credit cards

- Vehicle loans

- School loans

Make it automatic!

Use the Debt Snowball strategy

- Account for every income dollar in your budget

- Momentum > Math

The snowball turns into an AVALANCHE

Debt Snowball Example

| Rank | List of debts | Interest rate | Amount | Month Min |

|---|---|---|---|---|

| 1 | Credit Card #1 | 22% | 6000 | 50 |

| 2 | Car Loan | 8% | 17000 | 500 |

| 3 | Credit Card #2 | 20% | 20000 | 100 |

| 4 | School loan | 3% | 150000 | 200 |

| 5 | House | 6% | 250000 | 1,500 |

How to do the Debt Snowball

- List all debts from smallest to the largest with the minimum monthly payment due for each debt

- Pay the minimum due on each debt every month and add $100/mo (more, if possible) towards the smallest debt

- When the smallest debt is paid off, add that amount to the minimum of the second smallest debt

- Repeat until all debts have been cleared

Do Not Carry Credit Card Debt

Pay your credit card balance in full every month

Automate this!

Avg interest rate with an unpaid balance is pushing 17%!

Protect Yourself with a Credit Freeze

- Equifax

- Equifax.com/personal/credit-report-services

- 800-685-1111

- Experian

- Experian.com/help

- 888-EXPERIAN (888-397-3742)

- Transunion

- TransUnion.com/credit-help

- 888-909-8872

Step 3: Fill your Emergency Fund

Emergency Fund

6 - 9 months of expenses

- Is it an unexpected cost?

- Is it a necessary cost?

- Is it urgent?

Automate this!

Step 4: Saving/Investing

Saving = Paying off debts = Investing

Fiduciary Standard

Make financial advisor commit to a fiduciary standard

Save, Save, Save

Save 20% of your money.

Saving = Paying off debts = Investing

Why 20%?

Your time to reach retirement depends on only one factor: Your Savings Rate

- How much do you take home

- Home much can you live on

| Savings Rate | Years Until Retirement |

|---|---|

| 5 % | 66 |

| 10 % | 51 |

| 15 % | 43 |

| 20 % | 37 |

| 25 % | 32 |

| 30 % | 28 |

| 35 % | 25 |

| 40 % | 22 |

| 45 % | 19 |

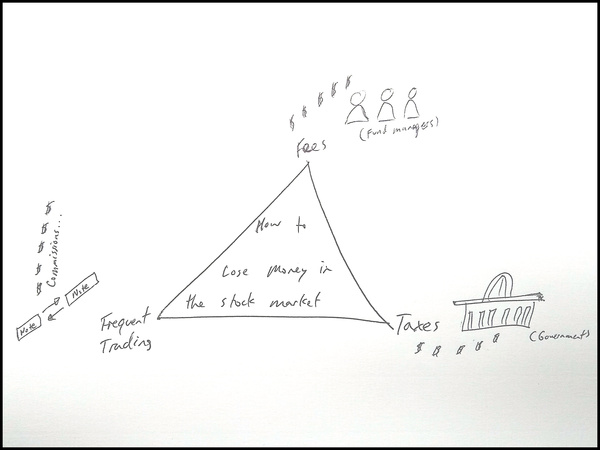

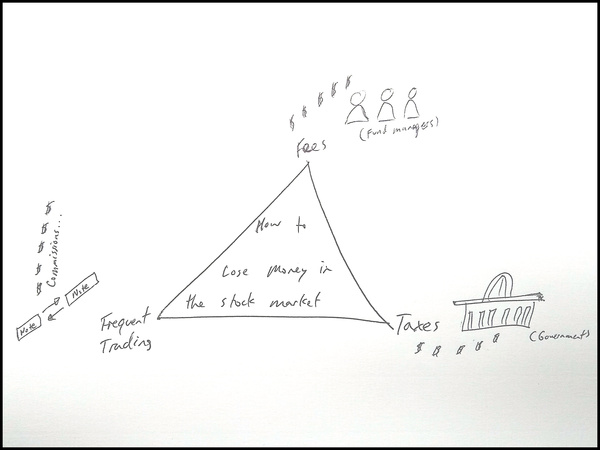

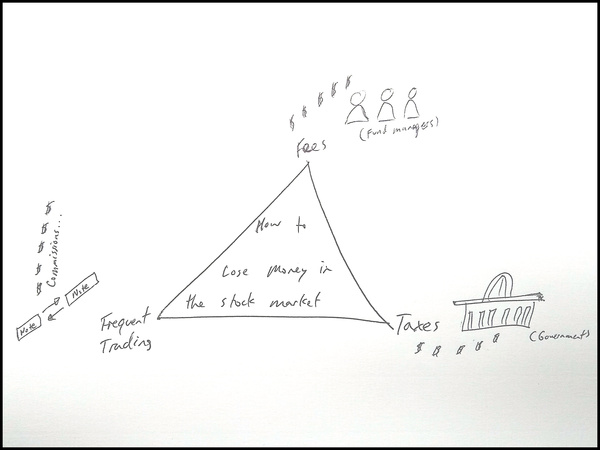

How to Lose Money in the Stock Market

Don't gamble in the market

Never buy or sell an individual security

- GOOG

- WMT

- DIS

- TGT

- HD

- etc…

Fees! Fees! Fees! (fees)

- Pay attention to fees - Avoid actively managed funds

- 80% don’t do as well as the market after 5 years!

| Active Managed | Passive Managed | |

|---|---|---|

| Avg annual fee | 0.76% | 0.08% |

| If 10k over 10yrs with 5% return | $15,150 | $16,165 |

Difference: $1,015

Minimize Fees

Buy inexpensive, well diversified mutual funds

- Invest with Index funds (Funds that track an index):

- Diversified

- Have low expense ratios

How to Lose Money in the Stock Market

Invest in Index Funds (frequent trading)

| Fund | Symbol | Expense Ratio |

|---|---|---|

| iShares Russell 2000 ETF | IWM | 0.19% |

| Vanguard Russell 2000 ETF | VTWO | 0.10% |

How to Lose Money in the Stock Market

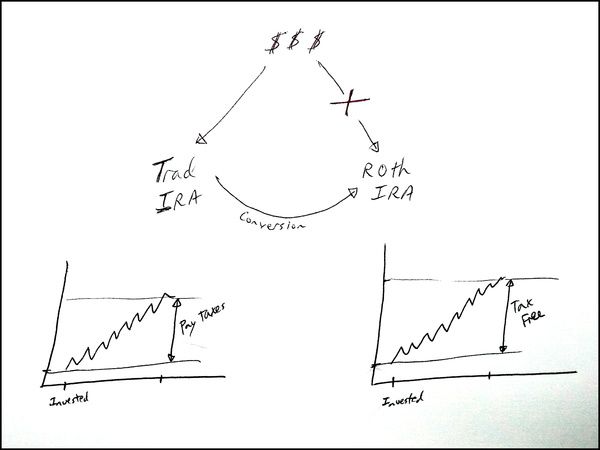

Lower your taxes! (taxes)

- Maximize tax-advantages savings vehicles such as:

- 401k/403b Retirement Accounts

- 529 Education Accounts

- Roth IRA Accounts

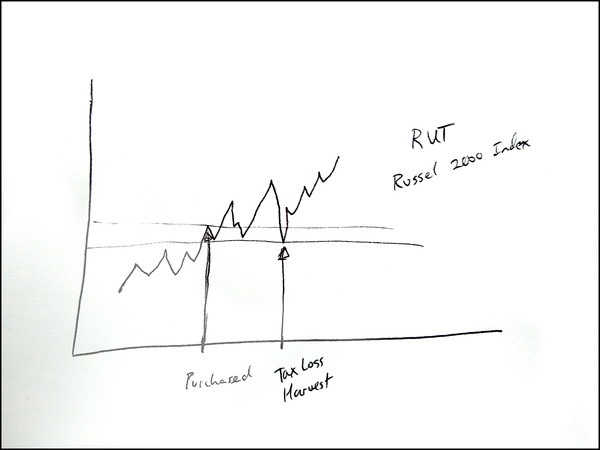

- Tax Loss Harvesting

Why prefer saving in a tax advantaged account?

| Pre-tax Version | Post-tax version | |

|---|---|---|

| Wages | $200,000 | $200,000 |

| Retirement Savings | $6,500 | $6,500 |

| Taxable wages | $193,500 | $200,000 |

| Tax rate (20%) | $38,700 | $40,000 |

| Take Home Pay | $154,800 | $153,500 |

Difference: $1,300

Over 30 years, investing that extra $1,300 (with 6.5% growth) = $119,586 in additional savings just by using a pre-tax retirement fund!

Claim your full compensation

Maximize your 401k or equivalent employee contribution

Automate this!

Tax Loss Harvesting

What should you invest in?

Depends on your risk tolerance…

- Asset characteristics:

- Stocks: More volatile (go up and down faster and more frequently)

- Bonds: Safer (do not go up or down as fast or often)

- Domestic: US based (generally regarded safer)

- International: Not US based (higher risk but likely more growth)

Simple Option - Just 1 Fund:

A Target Fund like: BlackRock LifePath Index 2045

Slightly More Complicated Option - 3 Fund Portfolio:

| Conservative (20/80) | Moderate | Aggressive (80/20) | |

|---|---|---|---|

| US Stock | 14% | 34% | 64% |

| Intl Stocks | 6% | 33% | 16% |

| Bonds | 80% | 33% | 20% |

AH Options for a 3 Fund Portfolio

- Domestic Stocks

- BlackRock Russell 3000 Index

- SDA U.S. Equity Market Fund

- International Stocks

- BlackRock MSCI ACWI ex-U.S. IMI Index

- SDA International Equity Index Fund

- Bonds

- BlackRock U.S. Debt Index

- SDA Total Market Bond Index Fund

Step 5: College funding

529 Plans

- Asset protected

- Tax advantaged

Types of 529 plans

- Savings plans

- More common

- Function much like a savings account

- Can withdraw for educational purposes tax free!

- Prepaid plans

- Less common (only 11 states have them including FL)

- Directly "pre-paying" for tuition

- Based on current tuition rates

Step 6: Pay off Home Loan Early!

Purchasing a Home:

- Aim for a payment less than 25% of your monthly take-home pay

- 15-year fixed-rate mortgage

- Put at least 10-20% down (Avoid PMI)

- Remember additional costs (like maintenance and repair)

Example Mortgage

Assumptions (April 2024):

- Average home price in Orlando: $372,206

- Typical rent in Orlando: $1,960/mo

- Current 15 year home interest rate: 6.44%

- Current 30 year home interest rate: 7.17%

Example Mortgage (Same house)

$300,000 home and you have a 20% down payment ($60,000) to avoid PMI

| Mortgage Term | Interest Rate | Monthly Payment | Total Interest | Total Cost |

|---|---|---|---|---|

| 30-year fixed | 7.17% | $1,624.22 | $344,719.20 | $584,719.20 |

| 15-year fixed | 6.44% | $2,082.75 | $134,895.00 | $374,895.00 |

| Difference | $458.53 | $209824.20 | $209,824.20 |

Example Mortgage (Same monthly payment)

Assume you budget that you can pay max of $1,800 a month with a 20% down payment

| Mortgage Term | Monthly Payment | Asking Price | Loan Amount | Total Interest | Total Cost |

|---|---|---|---|---|---|

| 30-year fixed | $1,800.00 | $332,467.18 | $265,973.74 | $382,026.26 | $648,000.00 |

| 15-year fixed | $1,800.00 | $259,272.65 | $207,418.12 | $116,581.88 | $324,000.00 |

| Difference | $73,194.53 | $58,555.62 | $265444.38 | $324,000.00 |

Can buy 28% "bigger/better" house but pay 100% more.

Pay it off faster!

Use biweekly payments

- Take your monthly mortgage amount and divide in half

- Pay that payment every 2 weeks

- Over the course of a year, you will pay an extra full payment towards the principal cutting off years of payments!

(Alternatively: Pay an extra 10% monthly)

Make it automatic!

Step 7: Build wealth and give!

CHANGE THE WORLD!

Make a difference

Seek opportunities

Insurance Information

- Life insurance

- Long-term disability

- Homeowner's Insurance

- Health Insurance

Life insurance

The sole purpose of life insurance:

To replace your income in case you die, so that your dependents can maintain their current lifestyle

All policies are one of two types:

- Term policies (or pure insurance coverage)

- Buy enough term coverage to fill your needs

- Match the term of the policy to your needs

- Buy when you're healthy

- Many variants of

whole life(which combine an investment product with pure term insurance and build cash value)Whole lifepolicies are high commission productsWhole lifeis expensiveWhole-lifepolicies are built on assumptions

What should you do?

- Term life policy

- 8 - 10 times your yearly income

- Keep your investing and insurance strictly separate.

- There are better places to invest - without the high commissions of whole-life policies

Long-term Disability Insurance

- Usually cheapest through your workplace.

- 30% of the workforce today will become disabled before they retire

- The average monthly benefit from Social Security disability has been $1,004 a month - You need a backup plan!

Homeowner's Insurance

Get a homeowner's policy that has guaranteed replacement costs

Say no to mortgage insurance policies

These pay off the balance on your mortgage if you die

Money Tools/Websites

- Budgeting: Personal Capital / Spreadsheets (Vertex42) (Google) / HomeBank

- Investing: Fidelity / Personal Capital / Vanguard / SoFi

- Taxes: FreeTaxUSA / TurboTax / H&R Block

- Banking: Ally Bank

Connect with Me

- Website: anchor-dpc.com

- Facebook: MatthewRensberryMD

- LinkedIn: Matthew-Rensberry-MD

- Twitter: @RensberryMD

- Email: Dr.Rensberry@anchor-dpc.com

Other Slides If Appropriate

RoboAdvisors

| Vanguard | Sofi | Charles Schwab | Fidelity Go | Ally | |

|---|---|---|---|---|---|

| Rebalancing | Yes | Yes | Yes | Yes | Yes |

| Tax loss Harvesting | Yes | No | Yes | No | No |

| Management fee | 0.15% | 0% | No | 0.35% | 0.3% |

| (Free is 30% cash) | |||||

| Account minimum | $3,000 | $0 | $5,000 | $0 | $100 |

| Human Advisor Support | No | Yes | Yes (Free) | Yes | Yes |

Former Slides Saved for Reference

Roth for High Earners (Min taxes)